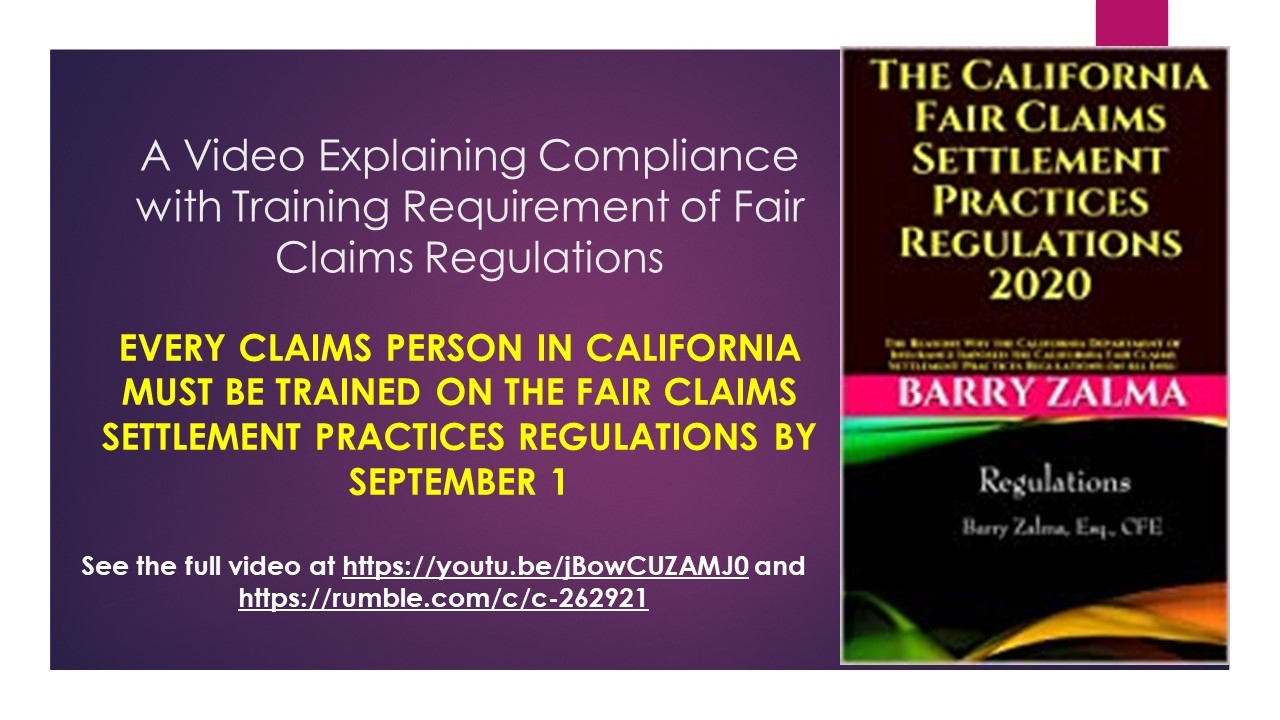

A Video Explaining Compliance With the California Fair Claims Settlement Practices Regul

Every Claims Person in California Must Be Trained on the Fair Claims Settlement Practices Regulations by September 1

See the whole article at https://www.linkedin.com/pulse/video-explaining-compliance-training-requirement-fair-barry and see the full video at https://youtu.be/jBowCUZAMJ0 and https://rumble.com/c/c-262921 and at https://zalma.com/blog plus more than 3850 posts.

The Reasons Why the California Department of Insurance Imposed the California Fair Claims Settlement Practices Regulations on All Insurers Doing Business in California

In 1993, after waiting five years after receiving direction from the California Supreme Court, the state of California determined that the insurance industry needed to be regulated to stop insurers from treating the people insured badly and without good faith. It created a set of Regulations called the “California Fair Claims Settlement Practices Regulations 2020” (the “Regulations) that were designed to enforce the mandate created by the California Fair Claims Settlement Practices statute, California Insurance Code Section 790.03 (h). in response to the direction of the California Supreme Court in its decision, Moradi-Shalal v. Fireman’s Fund Ins. Companies, 46 Cal. 3d 287 (1988).

In so doing the California Department of Insurance (CDOI) issued rules that were designed to micro manage the business of insurance claims and create a method to punish those insurers who failed to comply with the Regulations. Some of the Regulations recited what had always been recognized by the insurance industry as good faith and proper claims handling. Others imposed draconian mandates on what and when to do everything in the claims process.

The Regulations also provided a guide to insureds, public insurance adjusters and policyholders’ lawyers to assert any violation of the Regulations to be evidence of an insurer’s breach of the implied covenant of good faith and fair dealing.

All insurers doing business in California must comply with the requirements of the Regulations or face the ire of, and attempts at financial punishment from, the CDOI.

Knowledge of the requirements of the Regulations is important to everyone involved in the business of insurance whether as an insurance adjuster, insurance claims management, public insurance adjuster, policyholder, defense lawyer, insurance coverage lawyer, and policyholder’s lawyer.

ZALMA OPINION

Being trained annually on the California Fair Claims Settlement Practices Regulations are mandatory to everyone involved in insurance claims in the state of California. Failure to train each employee or obtain a sworn statement from the employee that avers that the employee has read and understands the Regulations will subject the insurer to massive fines. The book, “California Fair Claims Settlement Practices Regulations 2020” will allow each employee to easily comply with the Regulations.

We are 100% funded for October.

Thanks to everyone who helped out. 🥰

Xephula monthly operating expenses for 2024 - Server: $143/month - Backup Software: $6/month - Object Storage: $6/month - SMTP Service: $10/month - Stripe Processing Fees: ~$10/month - Total: $175/month

- Art

- Causes

- Crafts

- Crime

- Dance

- Drinks

- Film

- Finance

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Paranormal

- Autre

- Politics

- Stories

- News

- Party

- Science

- Religion

- Shopping

- Sports

- SyFy

- Politically Incorrect

- Philosophy

- Theater

- Technology

- Wellness