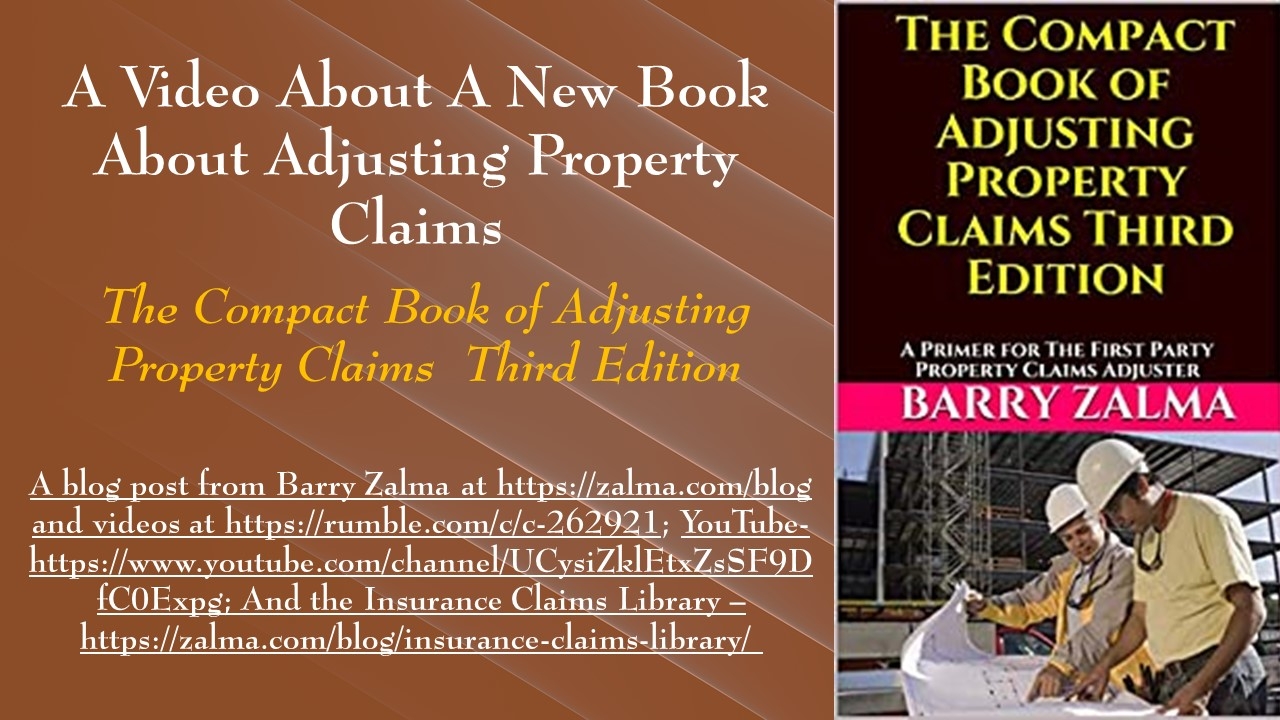

New Property Claims Adjusting Book Now Available

“The Compact Book of Adjusting Property Claims – Third Edition”

Read the full article at https://www.linkedin.com/pulse/video-new-book-adjusting-property-claims-barry-zalma-esq-cfe and see the full video at https://rumble.com/veo7jv-a-video-about-a-new-book-about-adjusting-property-claims.html and at https://youtu.be/AGG2Q-tMoJE and at https://zalma.com/blog and more than 3600 posts.

The insurance adjuster is seldom, if ever, mentioned in a policy of insurance. The strict wording of the first party property policy sets the obligation to investigate and prove a claim on the insured.

Standard first party property insurance policies, based upon the New York Standard Fire Insurance policy, contain conditions that require the insured to, within sixty days of the loss, submit a sworn proof of loss to prove to the insurer the facts and amount of loss. In general, failure to file the proof within the time limited by the policy is fatal to an action upon it (White v. Home Mutual Ins. Co., 128 Cal. 131, 60 P. 666). Beasley v. Pacific Indem. Co., 200 Cal.App.2d 207, 19 Cal.Rptr. 299 (Cal. App. 1962).

The insurer can either accept or reject the proof submitted by the insured.

A newly revised and updated book on property claims adjusting by Barry Zalma.

We are 100% funded for October.

Thanks to everyone who helped out. 🥰

Xephula monthly operating expenses for 2024 - Server: $143/month - Backup Software: $6/month - Object Storage: $6/month - SMTP Service: $10/month - Stripe Processing Fees: ~$10/month - Total: $175/month

- Art

- Causes

- Crafts

- Crime

- Dance

- Drinks

- Film

- Finance

- Fitness

- Food

- Spiele

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Paranormal

- Other

- Politics

- Verzeichnis

- News

- Party

- Science

- Religion

- Shopping

- Sports

- SyFy

- Politically Incorrect

- Philosophy

- Theater

- Technology

- Wellness