-

News Feed

- EXPLORE

-

Pages

-

Groups

-

Events

-

Blogs

-

Marketplace

-

Offers

-

Jobs

-

Developers

Coronavirus: US in emergency rate cut as coronavirus spreads

The US central bank has slashed interest rates in response to mounting concerns about the economic impact of the coronavirus.

The Federal Reserve lowered its benchmark rate by 50 basis points to a range of 1% to 1.25%.

The emergency move comes after the G7 group of finance ministers pledged action earlier on Tuesday.

It follows warnings that slowdown from the outbreak could tip countries into recession.

In a statement, the Fed said that the US economy remained "strong. However, the coronavirus poses evolving risks to economic activity."

"In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by half a percentage point to 1% to 1.25%," it said.

"The Committee is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy."

The last time the bank made an interest rate cut at an emergency meeting was during the global financial crisis of 2008.

The decision is a "dramatic turnaround from last week", when Fed officials appeared confident that rates, already low by historical standards, would not need to be cut further, said Paul Ashworth, chief US economist at Capital Economics said.

"With financial markets in turmoil and evidence growing that the coronavirus is developing into a pandemic, the Fed's change of heart is entirely understandable," he said.

Earlier on Tuesday, both Australia and Malaysia cut interest rates as a result of the outbreak, while finance ministers from the G7 group of nations pledged to use "all appropriate policy tools" to tackle the economic impact of coronavirus.

The group of major economies said in a joint statement they were monitoring the outbreak and ready to deploy "fiscal measures".

- Up to fifth of UK workers 'off sick at same time'

- How is the UK planning for an outbreak?

- What is coronavirus and what are the symptoms?

- Coronavirus: What are the chances of dying?

On Monday, the Organisation for Economic Cooperation and Development (OECD) warned the global economy could grow at its slowest rate since 2009 this year because of the virus.

The influential think tank forecast growth of just 2.4% in 2020, down from 2.9% in November, but it said a longer "more intensive" outbreak could halve growth and tip many countries into recession.

There were also sharp falls on global stock markets last week.

However, European stock markets started to rebound on Monday amid signs that governments and major central banks would work together to tackle the economic hit of coronavirus.

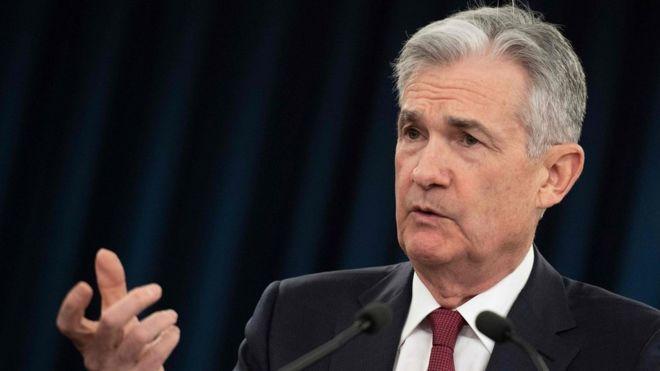

US President Donald Trump has repeatedly called on Fed Chair Jerome Powell to lower interest rates, ignoring tradition that presidents stay quiet on bank policy to preserve the bank's independence.

On Tuesday, he said the bank should cut further. "It is finally time for the Federal Reserve to LEAD. More easing and cutting!" he Tweeted.

Peter Tuchman, a stock trader at Quattro Securities, said he did not think the markets would necessarily welcome the move. "They're doing it to support the markets but that makes people fearful that we must be in bad shape," he told the BBC.

"To pull that bullet out so fast and so furiously leaves us with not that much ammo," he said.

We are 100% funded for October.

Thanks to everyone who helped out. 🥰

Xephula monthly operating expenses for 2024 - Server: $143/month - Backup Software: $6/month - Object Storage: $6/month - SMTP Service: $10/month - Stripe Processing Fees: ~$10/month - Total: $175/month

- Art

- Causes

- Crafts

- Crime

- Dance

- Drinks

- Film

- Finance

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Paranormal

- Other

- Politics

- History

- News

- Party

- Science

- Religion

- Shopping

- Sports

- SyFy

- Politically Incorrect

- Philosophy

- Theater

- Technology

- Wellness