Just a Warning and Wake Up Call As We All Get Redirected to the COVID Sham - The Current National Debt Status

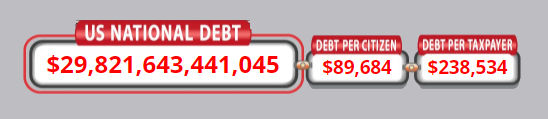

According to the U.S. Real Time Debt Clock, our national debt stands at $29.86 Trillion dollars. Nearly 30 Trillion $!!!

Now, considering that if you had 1 Trillion (that is 1 as in one) seconds to live, you would reach an age of 31,710 years, a Trillion is a shxxload of money!!! https://www.usdebtclock.org/

We now have almost 30 of these in dollars as debt, which spread out among the known legal population amounts to:

Nearly $90,000 per man, woman and child

Or

$238,534 per taxpayer

BTW, when Trump took office in 2016, the debt stood at $19.2 Trillion. That means, there has been a $10.6 Trillion rise in about 7 years.

Or, put another way, about a 55% rise in the national debt in about 7 years.

Any wonder why prices are rising? (More money circulating + less goods available = more rapidly rising inflation)

Our $ is less than 5 cents of its value when the Federal Reserve began in 1913 due to debt based inflation from printing more money with no rise in production and or anything to back it.

In other words, 5 cents or less back in 1913 would purchase what a $ would today.

When inflation reaches runaway hyper inflation, the currency upon which our economy is based collapses.

Prepare accordingly. A word to the wise is sufficient.

#inflation #nationaldebt #governmentspending #dollarcollapse

According to the U.S. Real Time Debt Clock, our national debt stands at $29.86 Trillion dollars. Nearly 30 Trillion $!!!

Now, considering that if you had 1 Trillion (that is 1 as in one) seconds to live, you would reach an age of 31,710 years, a Trillion is a shxxload of money!!! https://www.usdebtclock.org/

We now have almost 30 of these in dollars as debt, which spread out among the known legal population amounts to:

Nearly $90,000 per man, woman and child

Or

$238,534 per taxpayer

BTW, when Trump took office in 2016, the debt stood at $19.2 Trillion. That means, there has been a $10.6 Trillion rise in about 7 years.

Or, put another way, about a 55% rise in the national debt in about 7 years.

Any wonder why prices are rising? (More money circulating + less goods available = more rapidly rising inflation)

Our $ is less than 5 cents of its value when the Federal Reserve began in 1913 due to debt based inflation from printing more money with no rise in production and or anything to back it.

In other words, 5 cents or less back in 1913 would purchase what a $ would today.

When inflation reaches runaway hyper inflation, the currency upon which our economy is based collapses.

Prepare accordingly. A word to the wise is sufficient.

#inflation #nationaldebt #governmentspending #dollarcollapse

Just a Warning and Wake Up Call As We All Get Redirected to the COVID Sham - The Current National Debt Status

According to the U.S. Real Time Debt Clock, our national debt stands at $29.86 Trillion dollars. Nearly 30 Trillion $!!!

Now, considering that if you had 1 Trillion (that is 1 as in one) seconds to live, you would reach an age of 31,710 years, a Trillion is a shxxload of money!!! https://www.usdebtclock.org/

We now have almost 30 of these in dollars as debt, which spread out among the known legal population amounts to:

Nearly $90,000 per man, woman and child

Or

$238,534 per taxpayer

BTW, when Trump took office in 2016, the debt stood at $19.2 Trillion. That means, there has been a $10.6 Trillion rise in about 7 years.

Or, put another way, about a 55% rise in the national debt in about 7 years.

Any wonder why prices are rising? (More money circulating + less goods available = more rapidly rising inflation)

Our $ is less than 5 cents of its value when the Federal Reserve began in 1913 due to debt based inflation from printing more money with no rise in production and or anything to back it.

In other words, 5 cents or less back in 1913 would purchase what a $ would today.

When inflation reaches runaway hyper inflation, the currency upon which our economy is based collapses.

Prepare accordingly. A word to the wise is sufficient.

#inflation #nationaldebt #governmentspending #dollarcollapse